PACE (Property Assessed Clean Energy) Financing

PACE was originally conceived to fund deep sustainability retrofits to existing property, but it has emerged as ideal source of mezzanine capital to fund new construction or major renovations.

Think of PACE Financing as an off-balance sheet , voluntary special improvement district for commercial property owners to finance up to 20% of value for all project improvements that involve 1) utility cost impact or 2) disaster resilience, such as:

Think of PACE Financing as an off-balance sheet , voluntary special improvement district for commercial property owners to finance up to 20% of value for all project improvements that involve 1) utility cost impact or 2) disaster resilience, such as:

- New construction or value-add retrofit projects,

- Solar systems, new cool roof, HVAC systems, or LED lighting fixtures,

- Certain building code-required upgrades (like California's Title 24) or,

- A repair & maintenance/cap ex budget

PACE financing is an innovative public-private partnership, enabled by state legislation . PACE utilizes a land-secured bond that is repaid via semi-annual or annual assessments on the property tax bill - a feature that facilitates pass-through to tenants or hotel guests. The longer repayment terms (often 20 or more years), help make such investments more profitable compared to funding them with 7 to 10-year terms from traditional (debt & equity) financing sources.

Key Benefits & Features of PACE

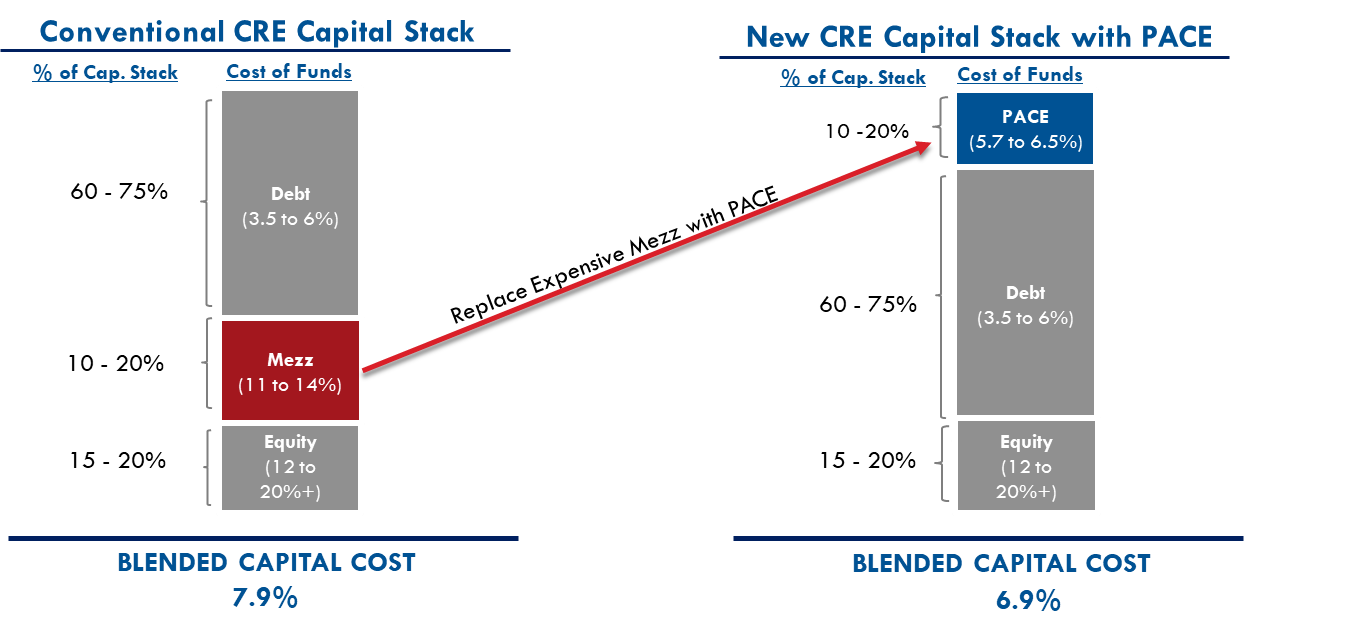

√ PACE significantly lowers the overall cost of project capital; is favorable to Mezzanine debt

- PACE functions like mezzanine debt in that it replaces or reduces equity in the capital stack.

- But in contrast to mezzanine financing, PACE is priced far more favorably, with 20-year fixed rates in the 5.70% to 6.50% range (versus 11% to 14% for short-term mezzanine debt)

- PACE financing does not come with restrictive operating covenants.

- PACE should not be compared to mortgage debt, as it is meant to fund alongside – but with consent of the lender (see below)

√ Facilitates Increase in Property Value

Increase NOI and cash flow. Energy & water efficiency and renewable energy improvements generate positive cash flow from the longer repayment terms. Many PACE funded retrofits involve substantial cash flow improvement in the first year

Increase marketability. Sustainability improvements modernize buildings and reduce potential price concessions that buyers may seek during the disposition phase. PACE qualified improvements include all direct and indirect costs to secure LEED, WELL or similar certifications

Increase Occupancy & Retention. Many of the property improvements qualified for PACE financing are integral parts of a value-added retrofit strategy an owner would pursue to modernize a building and make it more comfortable and efficient

Increase marketability. Sustainability improvements modernize buildings and reduce potential price concessions that buyers may seek during the disposition phase. PACE qualified improvements include all direct and indirect costs to secure LEED, WELL or similar certifications

Increase Occupancy & Retention. Many of the property improvements qualified for PACE financing are integral parts of a value-added retrofit strategy an owner would pursue to modernize a building and make it more comfortable and efficient

√ Off-balance sheet1

There may be no balance sheet impact from PACE financing, as it is levied on the same basis as property taxes. In the event of default, just like for recurring property taxes, there is no mechanism to accelerate

the PACE principal loan balance. And in the event of a foreclosure, the unpaid principal balance passes seamlessly to the new buyer, and the special assessment payments remain on the tax bill until balance is fully amortized

Not even a Force Majeure (or act of God) can cause a PACE loan balance to accelerate and become due

the PACE principal loan balance. And in the event of a foreclosure, the unpaid principal balance passes seamlessly to the new buyer, and the special assessment payments remain on the tax bill until balance is fully amortized

Not even a Force Majeure (or act of God) can cause a PACE loan balance to accelerate and become due

√ Designed to Pass Through Cost to Tenants / Occupants

While most NNN leases do not allow pass-through of interest or principal on debt-financed property improvements, PACE assessments qualify as operating expenses - allowing property owners to pass through the assessment to tenants (as increase in property taxes)

For hotels, subject to market conditions, owners can characterize all or some portion of the PACE assessment payments as a below-the-line room surcharge, similar to a tourism improvement fee (TIF).

This makes PACE financing particularly attractive for hotel owners!

For hotels, subject to market conditions, owners can characterize all or some portion of the PACE assessment payments as a below-the-line room surcharge, similar to a tourism improvement fee (TIF).

This makes PACE financing particularly attractive for hotel owners!

√ Less risk

- No refinance risk in that PACE was designed to fully amortize over the selected term

- Asset-Liability matching. PACE terms are equated to the weighted average estimated useful life (EUL) of the underlying improvements. Seismic strengthening would qualify for 30-years, while LED lighting mightbe 5 or 10 years

- Prepayable – terms can be negotiated

- No restrictive operating covenants, which often accompany mezzanine debt, as mentioned above

√ Non-recourse and No Guarantees. The property is the only security

√ Fully Assumable but also Prepay-able

- No qualification, no assignment or required fees, as assignment is automatic. The PACE assessment obligation just remains on the property tax bill until the unpaid balance is fully amortized

- This feature makes PACE the most “patient” capital source in the capital stack. Generally, all other forms of debt and equity are fully paid off upon sale of the underlying real estate assets. With PACE, the property owner has the option of paying off the outstanding principal balance upon sale (subject to prepayment penalty terms that may apply), but otherwise, the financing was designed to fully amortize to term

- Prepayment terms are negotiated, but common options include a 5-year lock-out then step-down prepayment premium starting in year 6 at 5%, then, 4%, 3%, 2%, 1% and 0% thereafter. Interest rates can be approved by substituting a yield maintenance provision for a specified term

√ 100% Funding

- Removes the ROI constraint. PACE allows building owners to dramatically modernize their building infrastructure and frees them from having to choose between such projects and other capital investments, which often have higher ROIs

- PACE funds 100% of all qualified project hard and soft costs, including labor, design or engineering analysis, capitalized (prepaid) interest, all costs incurred to attain LEED, WELL or related certifications and all financing closing costs

- Retroactive Funding. Can refinance completed projects in some jurisdictions 1+ years after completion

- The property owner retains all the benefits of these improvements, such as energy savings, etc., and more

- importantly, the full right to monetize any federal investment tax credits. (Note that if your entity cannot

√ General Underwriting Guidelines

- Generally, up to 20% LTV of PACE principal balance to appraised or as-completed value, but in cases of low leverage, PACE LTVs of up to 35% are possible. Max CLTV of 95% of appraised value or as-completed value, but in many circumstances, CLTVs of no higher than 80% will be required to obtain necessary secured lender consent to the PACE transaction. (See Lender Consent below)

- No property tax delinquency (3 years), BK filings (5 years) or state or federal liens

- DSCRs of generally at least 1.2X, though multifamily DSCRs of 1.0 possible. Note that DSCRs include the full impact of the PACE assessment payment, which represents an increase in property taxes. While PACE underwriting also includes the full impact of estimated savings from PACE-funded property improvements, there is no guarantee that a secured lender will credit 100% of such savings when processing the required PACE- Secured Lender Consent documents.

- The financing amount can be quite large - over $50 million if necessary.

PACE for Ground-up Construction

Most developers will seek to maximize construction-to-permanent mortgage debt for a new construction project (to 60-75%) and then fill the remaining 25% to 40% gap with equity and/or mezzanine debt. Other institutional investors or large REITs might employer lower leverage, often less than 50%, with favorable pricing in the 3-3.5% range, but then fund a larger percentage with equity. In both cases, the use of PACE financing will lower to overall cost of employed project capital by 100 basis points or more, such as from 7.9% to 6.9%, as illustrated in the graphic above.

√ Fund ~10% to potentially 20% of the total as-completed value

➫ Sizing depends on several factors, most notably DSCRs exceeding minimums required by secured lender

➫ Must include PACE P&I in NOI / DSCR, so projects that are barely meeting min ratios may not be good candidates (unless PACE is used to fund improvements that generate excess savings over code)

➫ Sizing depends on several factors, most notably DSCRs exceeding minimums required by secured lender

➫ Must include PACE P&I in NOI / DSCR, so projects that are barely meeting min ratios may not be good candidates (unless PACE is used to fund improvements that generate excess savings over code)

√ Financing available at closing (pre-construction) and even possibly post-completion in some jurisdictions (incl. CA)

√ Some PACE jurisdictions require a minimum savings over code (not in CA)

√ Funds must be applied to PACE eligible improvements (not land or acquisition cost)

√ Funding requires consent and coordination with secured (construction) lender (see below)

√ Some PACE jurisdictions require a minimum savings over code (not in CA)

√ Funds must be applied to PACE eligible improvements (not land or acquisition cost)

√ Funding requires consent and coordination with secured (construction) lender (see below)

Secured Lender Consent Required

Because PACE financing is secured by a tax lien and the repayment of the fixed principal & interest (P&I) is via property taxes, all commercial PACE transactions require the secured lender to acknowledge (or consent) that the proposed PACE transaction does not constitute an event of default, or directly or indirectly cause the exercise of any remedies under any documents related to the secured (mortgage) loan.

As of July 2017 , 162 mortgage lending institutions have consented to one or more PACE transactions, with some of the national lenders having provided numerous such consents.

As of July 2017 , 162 mortgage lending institutions have consented to one or more PACE transactions, with some of the national lenders having provided numerous such consents.

Reasons Why Secured Lenders Consent to PACE Transactions

√ Increased collateral value. PACE-funded improvements, by design, facilitate increases property value and often increases in NOI and Cash Flow. In some cases, PACE improvements, such as a roof replacement, do not directly improve cash flow. However, in the event of an REO sale, lenders recognize that a prospective buyer would deduct for roof replacement.

√ PACE Principal is not senior. Like any other tax assessment, only the current (unpaid) property tax installment due can comprise a lien in front of the first mortgage - not the outstanding principal on the PACE bond. There is no mechanism to accelerate the PACE principal balance, and no local municipality can lien future property taxes. Again, only delinquent property tax installments, including the fixed PACE P&I payments that attach as a special assessment, can form a senior lien in front of a mortgage holder

- So, assuming a 20-year amortization and maximum sized, 20% LTV, only a small fraction of the PACE principal balance can ever represent seniority, as a full year's installment is typically less than 2% of the property value

√ PACE P&I payments may be escrowed by the Lender in the same manner as other real estate taxes

√ PACE has no acceleration clause and by statute is subject to a full standstill

√ PACE has no due-on-sale and does not to be paid of upon refinancing

√ Unless voluntarily prepaid, PACE fully amortizes over its term, providing no balloon risk

√ PACE has no acceleration clause and by statute is subject to a full standstill

√ PACE has no due-on-sale and does not to be paid of upon refinancing

√ Unless voluntarily prepaid, PACE fully amortizes over its term, providing no balloon risk

√ P&I payments can be recovered from tenants. On many PACE transactions, the secured lender recognizes that the PACE P&I was designed to be passed through to tenants, and account for this in their DSCR calculations

√ PACE contains no technical defaults and is non-recourse to the owner

√ Designed to meet guidelines. The PACE investor (or program administrator) will not seek consent for a project that doesn't improve collateral value or meet minimum required leverage or income ratios.

√ Relationship Banking. Most lenders value their borrower relationships, and so long as their key underwriting parameters are maintained, they accommodate the borrower's efforts to upgrade and modernize their properties.

|

© 2018 Off Grid Capital Advisors | ALL RIGHTS RESERVED

|

Site by WPFCreatives

|